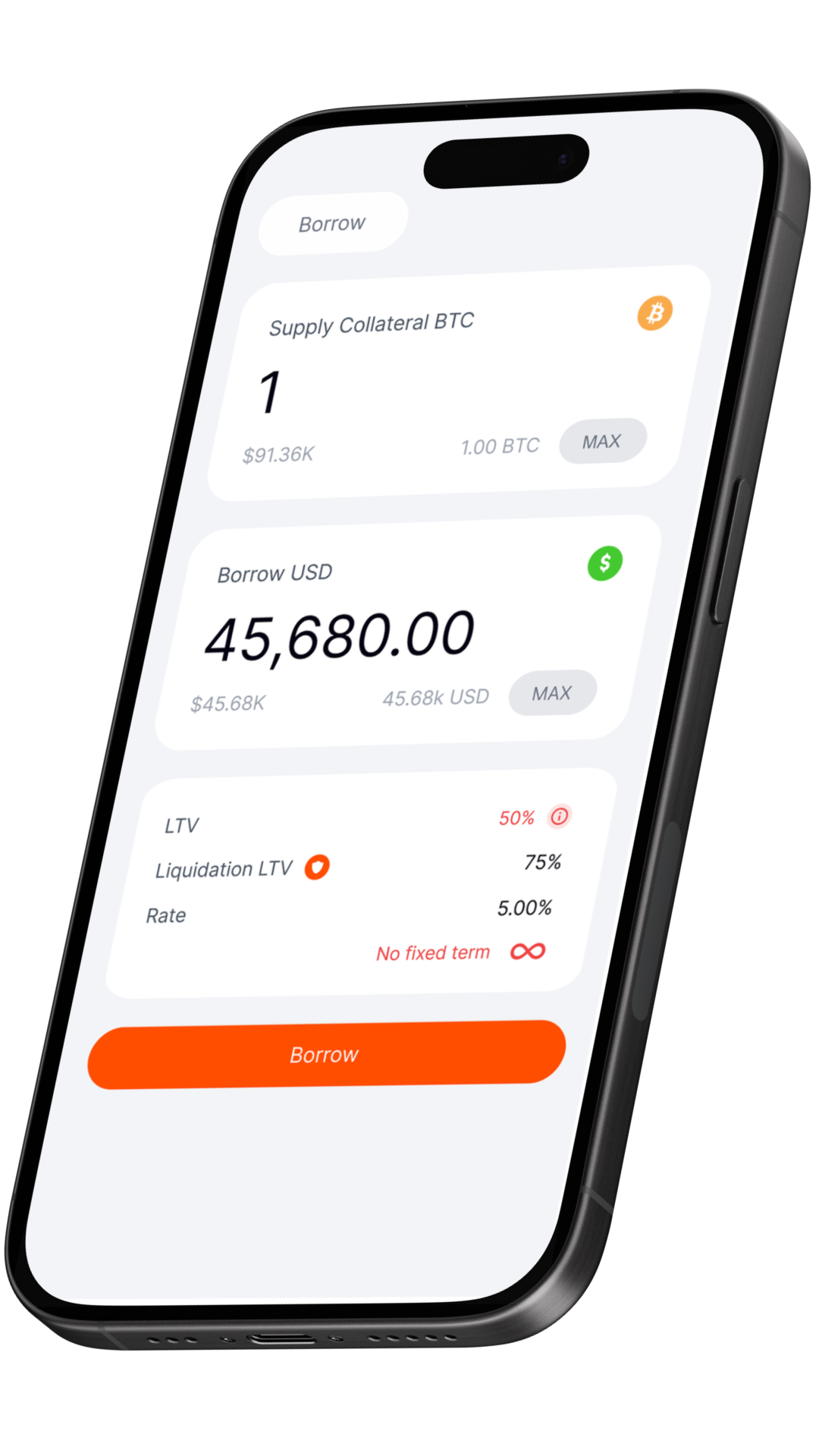

Your Gateway to

Digital Credit

Legasi is building an onchain

credit infrastructure that

lets you access long-term,

revolving fiat credit lines

backed by your digital assets.

Borrow on your terms.

Revolving

credit lines

No fixed terms,

designed for

long-term use.

No taxable

events

Your assets are

used as collateral,

not sold.

Lowest stable

interest rates

Predictable,

transparent,

and fair.

Stay in

control.

Legasi relies on a soft liquidation mechanism designed to protect collateral during market volatility.

Legasi relies on a soft liquidation mechanism designed to protect collateral during market volatility.

Time to adjust

repay, or add collateral

Designed for

peace of mind.

Automatic alerts

if your collateral value approaches critical levels

Partial adjustments

instead of forced sell-offs

Institutional-grade

custody.

Digital assets

kept native

No wrapping or bridging required.

Multi-signature

cold storage

Institutional-grade security standards.

Segregated

vaults

Each position relies on segregated collateral.

No

rehypothecation

Your assets are never reused or lent out.

Onchain

visibility

Collateral posture is designed to be verifiable.

Institutional-grade

custody.

Digital assets

kept native

No wrapping or bridging required.

Multi-signature

cold storage

Institutional-grade security standards.

Segregated

vaults

Each position relies on segregated collateral.

No

rehypothecation

Your assets are never reused or lent out.

Onchain

visibility

Collateral posture is designed to be verifiable.

Beyond Crypto:

Tokenized Real-world Assets

Pledge tokenized RWAs as collateral for your credit line.

FAQ

Get the most out of your Digital Assets

Be among the first to access next-generation, crypto-backed credit lines.