The Institutional Credit Layer

for Digital Assets

Unlock long-term, over-collateralized credit lines backed by crypto and tokenized RWAs

The Problem

For Crypto Holders

- Selling crypto triggers capital gains taxes

- DeFi protocols are complex, risky, and short-term focused

- Traditional banks don't accept crypto as collateral

- No clear path to access real-world liquidity

For Institutions

- Limited access to crypto-backed lending opportunities

- Regulatory uncertainty and compliance concerns

- Lack of institutional-grade infrastructure

- Missing yield opportunities in a low-rate environment

$2.5T+ in crypto assets remain idle, disconnected from traditional finance

Our Solution

Legasi bridges crypto wealth with real-world financial services through institutional-grade, over-collateralized credit lines

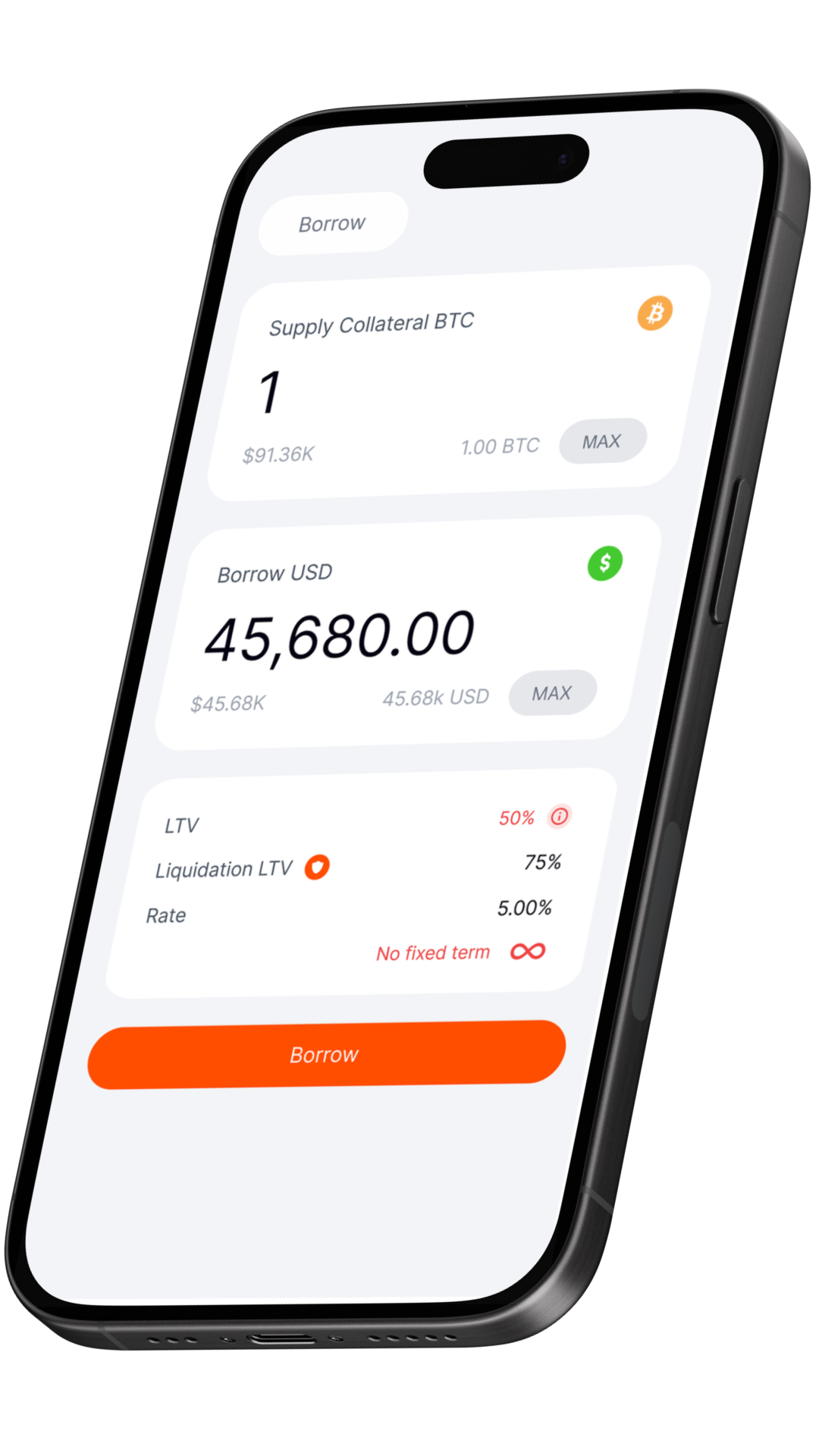

Pledge Crypto

Use BTC, ETH, or stablecoins as collateral in segregated, insured custody

Access Credit

Receive USD/EUR credit lines with stable rates and no fixed repayment date

Use Anywhere

Transfer to your bank account or spend with our integrated card solutions

50%

LTV for BTC

5%

Starting APR

No

Fixed Term

0

Tax Events

How It Works

Connect & Verify

Complete streamlined KYC and connect your wallet

Deposit Collateral

Transfer crypto to your segregated custody vault

Define Your Line

Set your credit amount and review terms instantly

Receive Funds

Get USD/EUR directly to your bank account

Market Opportunity

$2.5T+

Global Crypto Market Cap

$50B+

Crypto Lending Market

25%

Annual Growth Rate

Target Segments

Retail Crypto Holders

- High-net-worth individuals

- Long-term HODLers

- Tax-conscious investors

Institutional Lenders

- Family offices

- Credit funds

- Digital asset funds

Business Model

Revenue Streams

Interest Spread

2-3% margin on credit lines

Origination Fees

0.5-1% on new credit lines

Liquidation Fees

Revenue from risk management

Risk Management

Over-Collateralization

150-200% collateral ratio

Soft Liquidation

Gradual position reduction

Institutional Custody

Fireblocks-secured assets

The Team

Valentin Pouzolles

CEO & Co-founder

Former crypto broker with deep expertise in Lombard lending and institutional finance

Arthur Gaspard

CTO & Co-founder

Expert in software architecture and smart contracts with extensive DeFi experience

Roadmap

Q1 2025

Foundation

MVP development, regulatory framework, initial partnerships

Q2 2025

Beta Launch

Private beta with select users, BTC & USDC collateral support

Q3 2025

Public Launch

Full platform launch, institutional liquidity integration

Q4 2025

Expansion

RWA collateral support, additional asset types, geographic expansion